Here at Xero, we see the benefits of digitisation every day. Whether analysing trends across an anonymous dataset of more than 500,000 customers, or

Staying ahead in a changing industry: The 2019 Accounting Business Expo

In the race towards digitisation, virtually every industry on the planet is undergoing change. Few more so than the accountancy profession and the

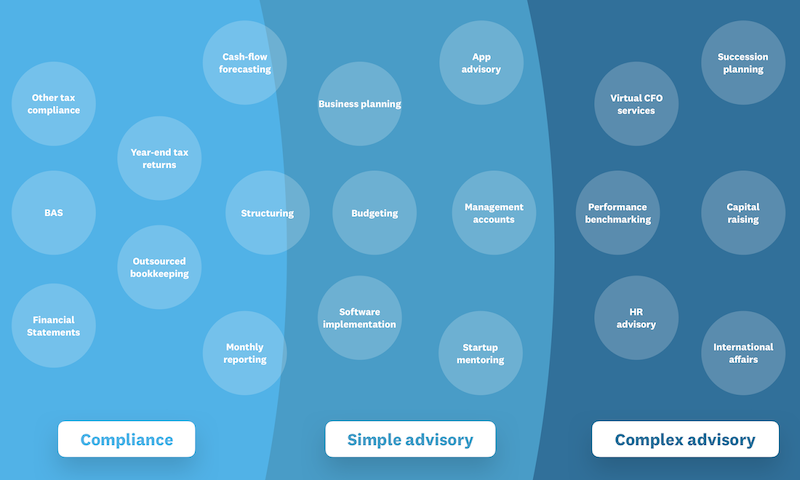

The Accounting Business Expo 2019: Your roadmap for moving down the advisory path

As part of the Beautiful Business Talks hosted by Xero at this year’s Accounting Business Expo, I was given the opportunity to present on how

Five reasons why you should use a BAS Agent

Safe HarbourIf you lodge your own BAS then you can get in trouble if there are mistakes or it’s overdue. You might even have to pay fines. If your BAS